About Financial Opportunity Center

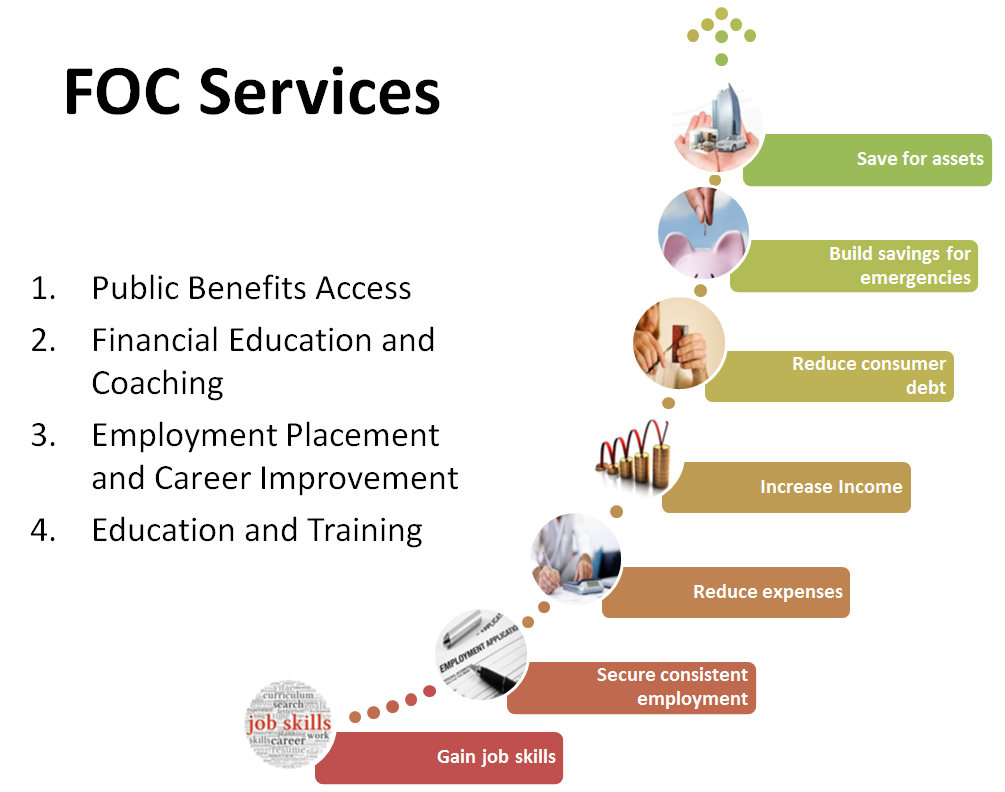

Financial Opportunity Center is a career and personal financial service center that focus on the financial bottom line for low-to-moderate income individuals, which is one of five in the Houston area. This means changing people’s financial behavior in a way that encourages them to make a long-term commitment to increasing income, decreasing expenses, and acquiring assets. The Financial Opportunity Center (FOC) provides families with services across three areas:

- Employment Placement and Career Improvement

- Financial Education and Coaching

- Public Benefits Access

The FOC Model

The FOC model integrates these core services and provides them to clients in a bundled fashion. Offering the services as a bundle is a holistic approach where the individual services reinforce each other and provide a multi-faceted approach to income and wealth building.

The FOC offers public benefits screening and application assistance. For more information, visit our Public Benefits page.

Frequently Asked Questions

Can you help me find a job?

As an FOC client, you will have opportunity to work with our employment coach who can help you craft a job search strategy, edit your resume, and improve your interviewing skills. We provide job referrals when we receive open positions from employers that match your qualifications and expectations. However, remember our primary goal at the FOC is to help you be as prepared as possible to find a job, not to find a job for you. We expect you to put in 100% effort in your job search.

How do I become an FOC Participant?

The first step towards becoming an FOC participant is to attend the Orientation Session. We have Orientation online via zoom every other Wednesday at 2:30 pm. To register for an upcoming FOC Orientation, please fill out this form. All registered attendees will receive a reminder email with zoom link before their scheduled orientation date. After orientation, staff will reach out regarding next intake steps.

Do I have to pre-register for FOC Orientation?

Yes, at this link.

Should I bring anything with me to orientation?

Notebook and pen. Must have stable internet connection and use a pc/laptop or smartphone with Zoom access.

Keep in mind you must have TX ID/Driver’s License, SSN Card (with work authorization), proof of at least HS Diploma/GED, and proof of income to pass vocational training program pre-eligibility screening.

*A $150-$350 program deposit fee applies to select training programs and it will be refunded after obtaining your certification and employment in the field of training.

I’m interested in a vocational training program, how can I sign-up?

The FOC program is the umbrella program over all of our job training classes, so we encourage job seekers who want to learn more about available training to attend an upcoming FOC Orientation Session. All our classes are grant-funded. Having your name on an interest list means that you will receive an email from us when a class and information session becomes available; it does not guaranteed a spot in the class. For more information on our vocational training programs, click on the “Vocational Training Programs” tab.

How do I become part of THRIVE program?

United Way THRIVE is a city-wide network of social service providers that assist community members with employment and financial services. CCC is one of those providers and we assist community members through our Financial Opportunity Center, our Housing Program, as well our Financial Capability Program which provides one-on-one financial coaching to non-FOC participants. If you are interested in our THRIVE services and are not sure which of these programs is the best fit for you, please contact Chelsy Aledia at caledia@ccchouston.org or (713) 271-6100 Ext. 130.

Videos

LISC Financial Opportunity Center at CCC

About LISC Financial Opportunity Centers

Financial Opportunity Center (FOC)

Contact Us

Nhi Truong

Financial Opportunity Center Director

ntruong@ccchouston.org

(713) 271-6100 Ext. 128

Hui Pan

Financial Coach

hpan@ccchouston.org

(713) 271-6100 Ext. 124