Financial Education

The Financial Education and Coaching program is to increase the financial knowledge and skills of adults from low- to moderate-income households in order to help them successfully navigate the mainstream financial services sector, increase savings and assets, improve their credit rating, buy a home, and achieve financial stability.

Financial Coaching

A financial coach will assist clients in a one-on-one setting to identify financial goals and to create a plan to reach those goals, overcoming financial obstacles and preparing a path towards financial sustainability for oneself and families.

- One-on-one coaching for financial guidance and support

- Money management for individual needs

- How to establish and maintain credit

- How to improve credit score

- Budgeting and Saving

- Investment and Retirement

- Enrollment of credit building financial products

Financial Education Workshops

Through group workshops led by the financial coach and by qualified representatives from partner organizations, clients develop literacy in the following areas:

- Available banking services and how to build a positive relationship with a financial institution;

- How credit works and how to determine when to apply for credit;

- How to use a credit card and checking account responsibly;

- The dangers of predatory lending;

- How to manage money by preparing a personal spending plan and identifying ways to decrease spending and increase income;

- Methods for budgeting and reaching savings goals; how to protect one’s finances and identity;

- How to read a credit report and how to build and repair one’s credit rating; and

- General information about installment loans, including car loans and home equity loans.

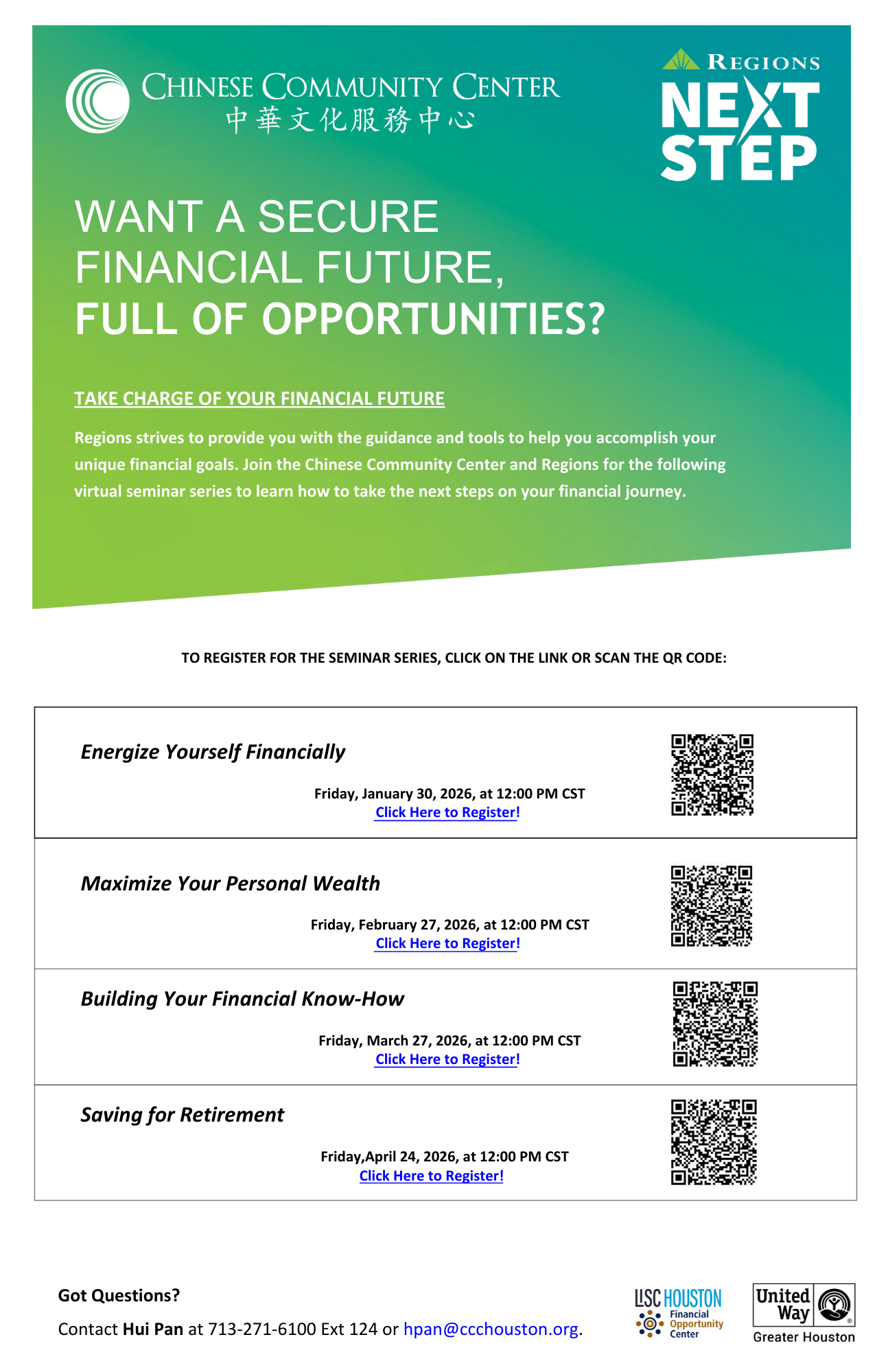

2026 Financial Education Workshop Schedule | Click HERE to register online

REGIONS NEXT STEP Small Business Financial Workshop Schedule

TBA

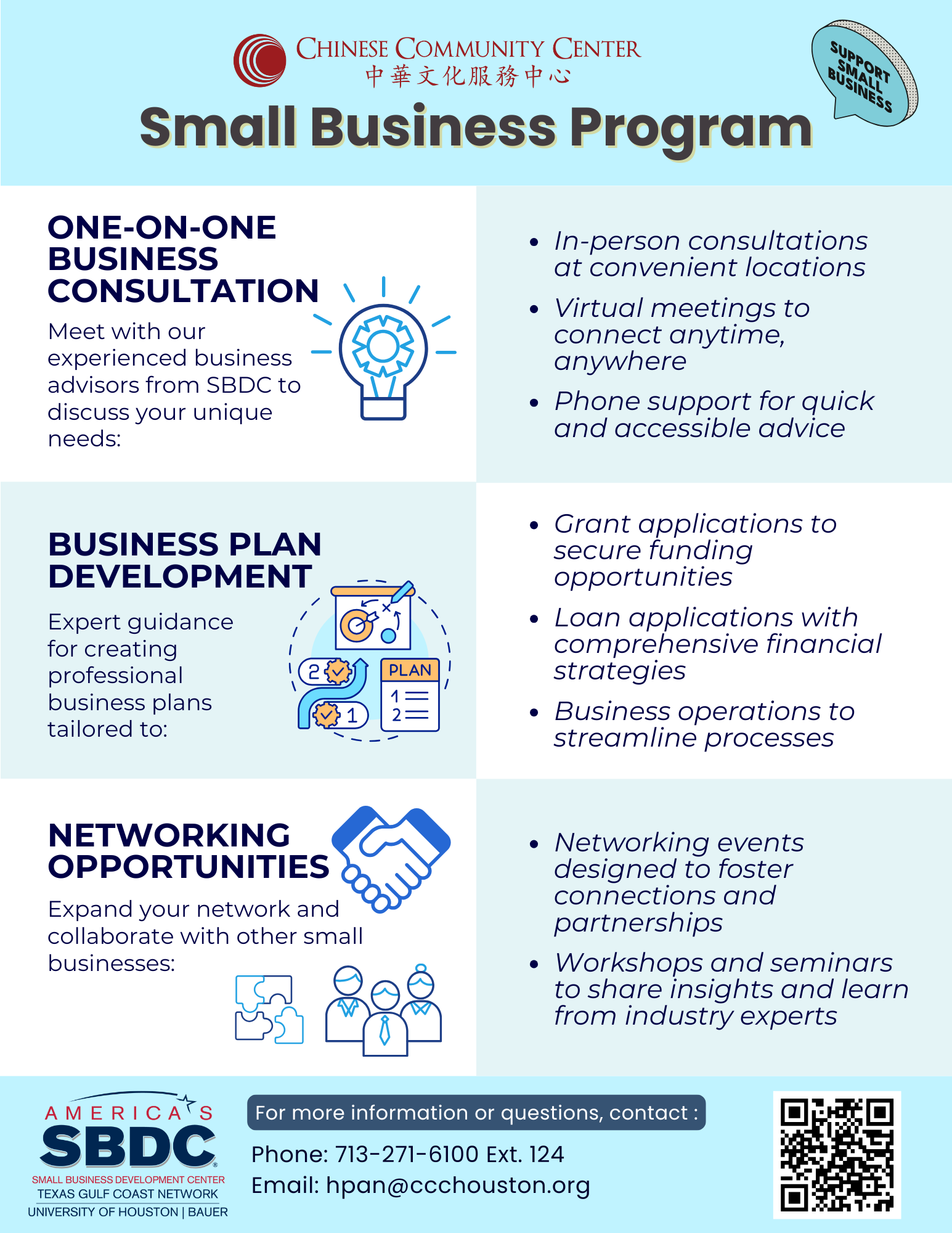

Resources from Texas Gulf Coast SBDC Network in Houston

We can connect you with Small Business Development Centers (SBDC) in Houston for personalized consultations tailored to your specific needs.

SBDC provides counseling and training to small businesses including working with SBA to develop and provide informational tools to support business start-ups and existing business expansion.

Verizon Small Business Digital Ready | Click HERE to register online

Income Support/Benefits

Financial Opportunity Centers (FOC) help low to moderate income families boost earnings, reduce expenses, and make appropriate financial decisions that lead to asset building through an integrated service model approach. The centers provide individuals and families with services across three critical and interconnected areas:

- Employment services

- Financial coaching

- Access to income supports.

Income Support Coach

The income supports coach, or public benefits specialist, provides direct services to low to moderate-income individuals who are enrolled as Financial Opportunity Center participants. Income supports specialists assist clients in finding ways to supplement their income, or reduce their expenses through benefits that the FOC will refer to as income supports. Income supports may include, but are not limited to public benefits such as food stamps, medical benefits, LIHEAP, and more; other benefits may include EITC, free eye glasses, emergency cash assistance. These income supports may be difficult to apply for, or challenging to find, or understand. Therefore, income supports specialist makes these benefits accessible to FOC clients.

Employment and Career

The Employment/Career Coaching Program helps to increase the job readiness/employ-ability of low-to-moderate income individuals. Our clients will successfully navigate the current job market, gain and improve skills needed, and achieve financial stability through long-term sustainable employment.

Employment and Career Coaching

An employment/career coach will assist clients in a one-on-one setting to identify career goals and to create a plan to reach those goals, preparing a path towards financial sustainability.

- Reviewing job application process

- Resume and cover letter development

- Interview strategy & Practice

- Networking strategy

- Job referrals

Job Readiness Courses

Through group workshops led by the employment/career coach and qualified representatives from partner organizations, clients develop skills in the following areas:

- Understanding the importance of and how to develop a resume, CV, cover letter, and/or portfolio

- Creating a personal data sheet for completing applications and/or cover letters

- Successfully completing a job application independently

- Developing a resource list

- Using appropriate skills to develop job leads

- Researching prospective employers and job positions based on individual skills, interests, and experience

- Conducting a successful interview

- Maintaining successful employment

Financial Opportunity Center (FOC)

Contact Us

Nhi Truong

Financial Opportunity Center Director

ntruong@ccchouston.org

(713) 271-6100 Ext. 128

Hui Pan

Financial Coach

hpan@ccchouston.org

(713) 271-6100 Ext. 124